pay indiana property taxes online

On Tax and Payments Payment. 20 N 3rd Street.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card.

. In case of delinquent. 800AM400PM Saturday Sunday Legal Holidays. In Indiana aircraft are subject to.

Choose any business day on or before the due date to make a one-time payment of your property taxes. For all the available ways to pay your tax bill. You will need your tax bill and checkbook or Credit Card.

E-Check Visa Mastercard Discover and American Express accepted. Elkhart County is excited to offer residents an easy and convenient method to view and pay their real estate personal property and mobile home tax bills online. Can you pay Indiana property taxes with a credit card.

This exemption provides a deduction in assessed property. Review and select the propertyparcel you wish to make a payment towards. Fort Wayne IN 46801-2540.

To pay your property taxes via our online system please visit the Property Tax Search page where you can search. This is a fee. Call 1-844-576-2177 and follow the prompts.

Know when I will receive my tax refund. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Use the Property Reports and Payments application to make online payments.

Online Payments - Visa MasterCard American Express or Discover credit cards debit cards. The Treasurer is an elected position authorized by of the Indiana Constitution and serves a four 4 year term. The primary duty of the Treasurer is that of tax collector.

Senior citizens as well as all homeowners in Indiana can claim a tax deduction if their home serves as their primary residence. The county offers a variety of housing options a strong job market and a variety of recreational and cultural. Find Indiana tax forms.

DOR offers customers several payment options including payment plans for liabilities over 100. Certified to Court Database. To pay your bill by mail please send your payment to.

Find Indiana tax forms. The fee for this service is 100 in addition to a 100 for electronic check. The Indiana Department of Revenue does not handle property taxes.

Please see payment optionquick link above. Here are your payment options. Main Street Crown Point IN 46307 Phone.

Pay Your Property Taxes. Use First Name Last Name Example. Please direct all questions and form requests to the above agency.

Credit and debit card transactions will incur a convenience fee of 235 of your total tax liability. South Bend IN 46634-4758. If you have an account or would like to create one or if you.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If requesting a receipt please include a self-addressed. Property Tax Payments - Search.

Welcome to the Lawrence County Indiana property tax payment website. FirstNameJohn and LastName Doe OR. Choose from the options below.

Porter County is a great place to live work and raise a family. 2022 General Election DEPARTMENT PHONE LIST Employment Opportunities Pay Traffic Citation Pay Court Fines and Fees Warrant Search Court Date Lookup Pay Property Tax Online. The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes.

You must register to schedule a. Know when I will receive my tax refund. Pay online quickly and easily using your checking or savings.

Building A 2nd Floor 2293 N.

Deducting Property Taxes H R Block

Office Of The Treasurer Tax Collector Home

Property Tax Payments Due By Oct 15 City Of Covington Ky

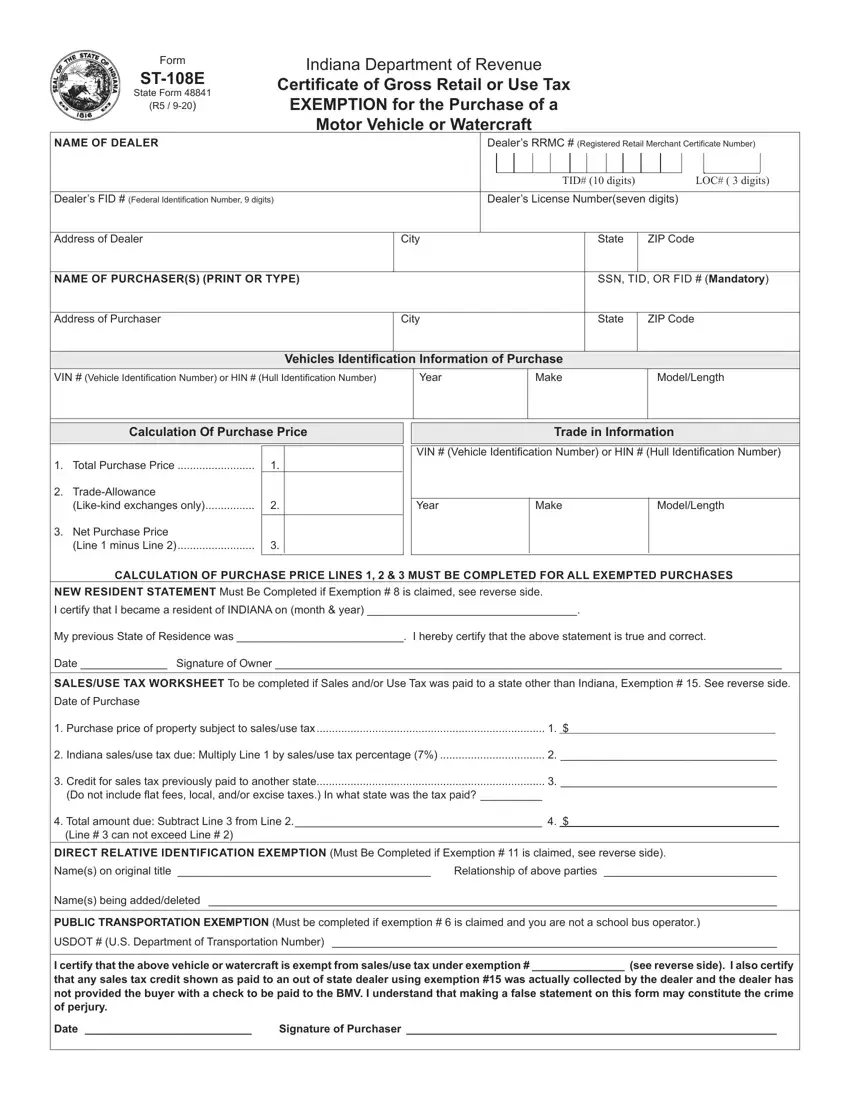

St 108e State Form Fill Out Printable Pdf Forms Online

What Happens If You Can T Pay Your Property Taxes

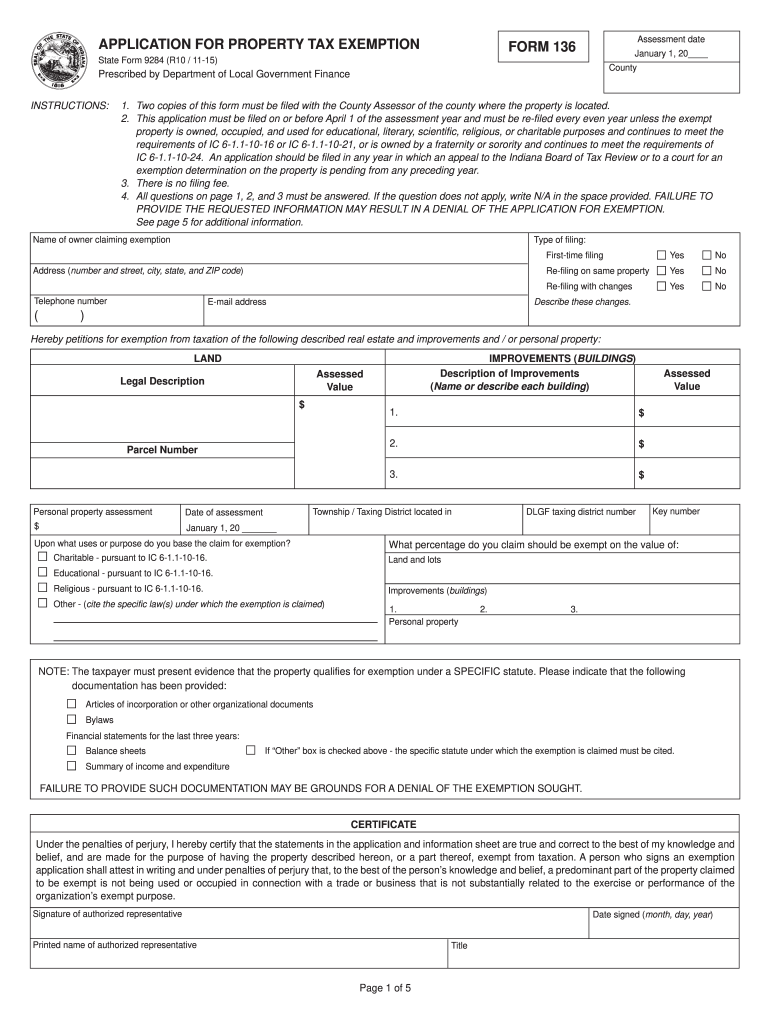

In State Form 9284 2015 2022 Fill Out Tax Template Online Us Legal Forms

How Taxes On Property Owned In Another State Work For 2022

Pima County Treasurer S Office

Fillable Online Indygov Indiana Property Tax Benefits State Form 51781 R2 106 R3 506 Prescribed By The Department Of Local Government Finance Instructions This Form Must Be Printed On Gold Or

How Cook County Homeowners Can Get A Sneak Peak At 2019 Tax Bills